vermont sales tax on alcohol

The tax is adjusted depending. The Vermont sales tax rate is 6 as of 2022 with some cities and counties adding a local sales tax on top of the VT state sales tax.

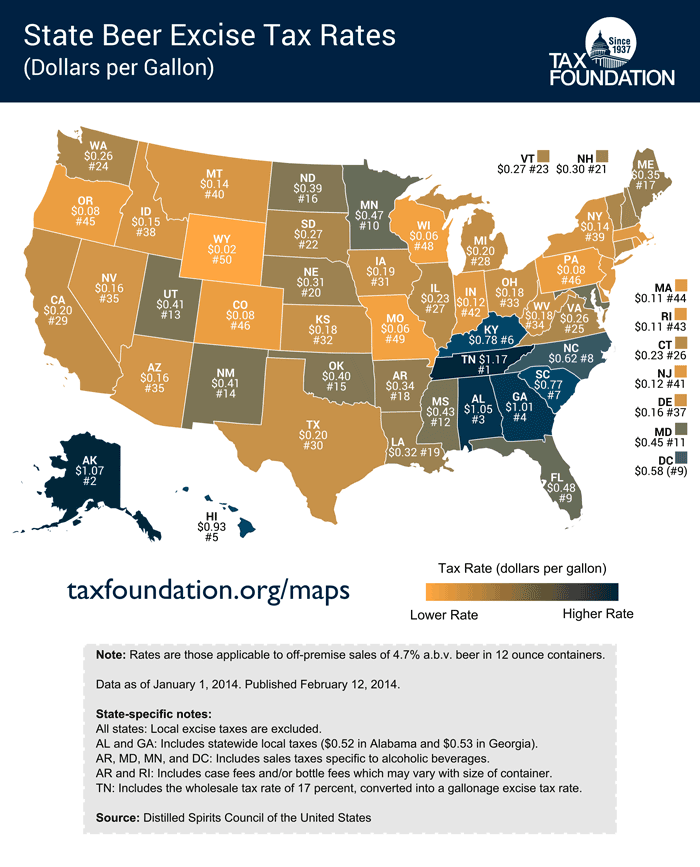

These States Have The Highest And Lowest Alcohol Taxes

Andor 3 any items subject to sales tax.

. W-4VT Employees Withholding Allowance Certificate. Alcoholic beverages subject to meals and rooms tax are exempt from sales and use tax. The VT Department of Liquor Lottery provides a regulatory framework for the responsible sale and consumption of alcohol tobacco and gaming entertainment ensuring public safety and contributing 100 of profits to Vermont communities through the General and Education funds.

6 Sales and Use Tax Sales of alcoholic beverages by retailers such as grocery stores or convenience stores that are suitable for human consumption contain one-half of 1 or more of alcohol by volume and are not provided for immediate consumption. 15th highest liquor tax. Obtaining and maintaining a liquor license entails numerous steps and may hinge on the applicants personal history and background.

All hard liquor stores in Vermont are state-owned so excise taxes for hard alcohol sales are set by the Distilled Spirits Council of the United States DISCUS. Preliminary reports are created 75 days after the end of the filing period. The maximum local tax rate allowed by Vermont law is 1.

If you are a new business go to Getting Started with Sales and Use Tax to learn the basics of Vermont Sales and Use Tax. Select the Vermont city from the list of popular cities below to see its current sales tax rate. In response all states instituted some form of three-tier system of producers wholesale.

Please note that you. Sales and Use Tax 32 VSA. A proof gallon is a gallon of liquid that is 100 proof or 50 alcohol.

Federal excise tax rates on beer wine and liquor are as follows. Vermont has state sales tax of 6 and allows local governments to collect a local option sales tax of up to 1. In order to control sales of alcoholic beverages many authorities at the state and local levels limit the number of licenses that can be issued by using a quota system.

See our website at taxvermontgov for information related to the necessary forms and for due dates. Average Sales Tax With Local. Alcoholic Beverage Sales Tax.

Exemptions to the Vermont sales tax will vary by state. Vermont Alcoholic Beverage Sales Tax 87238 KB File Format. There are many exemptions to the Vermont Sales and Use Tax including clothing and footwear food medicines newspapers certain agricultural products some purchases.

A Vermont Alcohol Tax can only be. Chapter 233 The sales and use tax is imposed on alcoholic beverages sold at retail that are not for immediate consumption. There are a total of 153 local tax jurisdictions across the state collecting an average local tax of 0153.

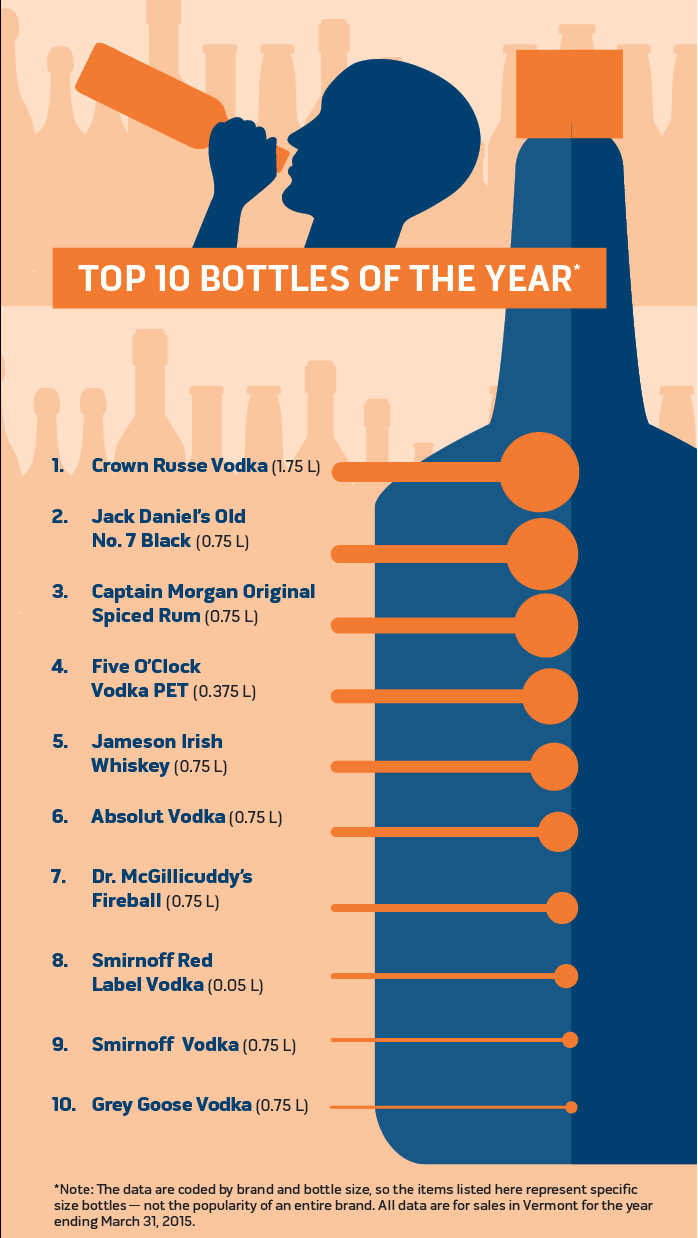

According to DISCUS the adult beverages are only available currently at 81 state-operated stores. The Vermont Division of Liquor Control DLC was created in 1933 when the 21st Amendment to the US. With local taxes the total sales tax rate is between 6000 and 7000.

You can lookup Vermont city and county sales tax rates here. Summary of Vermont Alcoholic Beverage Taxes Beer and Wine Gallonage Tax 7 VSA. PA-1 Special Power of Attorney.

The Vermont excise tax on liquor is 768 per gallon higher then 70 of the other 50 states. Control of the sale and distribution of alcohol was then transferred to state governments. The Vermont bill reduces taxes on packs of ready-to-drink spirits from 768 per gallon the rate at which spirits are taxed to 110 per.

Constitution repealed the Volstead Act Prohibition. Updated reports are created 180 days after the end of the filing period. Beginning July 1 the organization anticipates the drinks to be sold in more than 1000 retail stores in Vermont.

Amount of Sales Tax Rate 0-500000 5 500001-749999 25000. Free Unlimited Searches Try Now. Higher sales tax than 87 of Vermont localities -88817841970013E-16 lower than the maximum sales tax in VT The 7 sales tax rate in Manchester consists of 6 Vermont state sales tax and 1 Manchester tax.

Municipal governments in Vermont are also allowed to collect a local-option sales tax that ranges from 0 to 1 across the state with an average local tax of 0153 for a total of 6153 when combined with the state sales tax. For beverages sold by holders of 1st or 3rd class liquor licenses. Click here for a larger sales tax map or here for a sales.

107 - 340 per gallon or 021 - 067 per 750ml bottle depending on alcohol content. Local option tax is destination-based. The sales tax rate is 6.

The state sales tax rate in Vermont is 6000. 10 Alcoholic Beverage Tax 10 Alcoholic Beverage Tax applies to sales of. Vermont Sales Tax is charged on the retail sales of tangible personal property unless exempted by law.

The Department of Taxes publishes Meals and Rooms Tax and Sales and Use Tax data by month quarter calendar year and fiscal year. Effective June 1 1989. Vermont Use Tax is imposed on the buyer at the same rate as the sales tax.

May choose to levy a local option tax on 1 meals and alcohol. Ad Lookup VT Sales Tax Rates By Zip. Other items including gasoline alcohol and cigarettes are subject to various Vermont excise taxes in addition to the sales tax.

O Includes sales from State liquor agents to bars and restaurants. Vermont has recent rate changes Fri Jan 01 2021. 294 rows Vermont Sales Tax.

Vermonts excise tax on Spirits is ranked 15 out of the 50 states. Updated reports include more returns for any given period. IN-111 Vermont Income Tax Return.

Vermont according to DISCUS is following a trend other states have set by lowering taxes for lower alcohol percentage drinks.

How Does Selling Alcohol On Doordash Work

Liqour Taxes How High Are Distilled Spirits Taxes In Your State

States That Allow Alcohol Delivery What You Need To Know

15 Things To Know Before Buying Costco Liquor In 2022

How To Get A Liquor License In All 50 States Cost 2ndkitchen

Spirits Industry Pushes For States To Lower Taxes On Canned Cocktails

Connecticut S Liquor Pricing Scheme Is A Bad Law That Just Won T Die

Vermont Alcohol Taxes Liquor Wine And Beer Taxes For 2022

Launching Your Alcohol Brand In Control States Vs Open States

Vermont Legislature Expands Market For Ready To Drink Spirits Beverages Food Drink Features Seven Days Vermont S Independent Voice

Vermont Mulls Pros And Cons Of Privatizing Liquor Sales Business Seven Days Vermont S Independent Voice

Can Instacart Deliver Alcohol Yes But Not In Every State

These States Have The Highest And Lowest Alcohol Taxes

By The Numbers Virginia Ranks 3rd Highest On Alcohol Taxes Virginia Thecentersquare Com